legendplay USABrightline: Reviews and Ratings

Ever wondered what it’s like to find a company that actually makes things easier in the often overwhelming world of loans? That’s where USABrightline comes in. This rising star specializes in document preparation for loan companies, bringing a refreshing approach to a complicated process.

We’ve spent countless hours researching USABrightline’s services, customer feedback, and loan offerings to bring you this comprehensive review. Whether you’re dreaming of that kitchen renovation you’ve been pinning on Pinterest or looking to consolidate those pesky high-interest debts into one manageable payment, this guide will help you understand if USABrightline is your perfect financial match.

By opening an account with USABrightline, you can unlock funds and facilitate fast loan approvals, making your financial journey more convenient and empowering.

In this guide, we’ll dive into what makes USABrightline unique, explore their services, and share insights from customers who’ve worked with them. By the end, you’ll have a clear understanding of whether USABrightline is the right partner for your loan business.

What Is USABrightline?

Have you ever felt like navigating the loan landscape is like trying to solve a Rubik’s cube blindfolded? Well, you’re not alone! In today’s financial maze, finding a trustworthy lending partner can feel like searching for a needle in a haystack.

That’s where USABrightline comes into the picture, emerging as a beacon of hope for many borrowers seeking clarity and simplicity in their loan journey. Think of them as your financial GPS, helping you navigate through the complex world of personal, home improvement, and consolidation loans.

An Overview of USABrightline’s Personalized Loan OptionsAt its core, USABrightline is a document preparation company. Think of them as the backstage crew that makes sure everything runs smoothly for loan companies. They specialize in creating compliant, accurate, and efficient documentation tailored to meet their clients’ specific needs.

Their key services include:

Preparing detailed and compliant loan documents. Speeding up the documentation process with accuracy. Offering scalable solutions for businesses, whether you’re a small loan provider or an established lender. Providing bright-line personalized loan options tailored to meet specific financial needs, empowering individuals with customizable loan solutions for significant purchases or managing unforeseen expenses.If you’re tired of drowning in paperwork, these folks might be your new best friends.

![]() Easy requirements

Easy requirements

4.5

4.5

![]()

![]()

![]()

![]()

![]() Loan amounts up to $100,000

Program/Service Details: Such as duration and requirements.

Certifications/Accolades: If any.

Loan amounts up to $100,000

Program/Service Details: Such as duration and requirements.

Certifications/Accolades: If any.

USABrightline’s mission is simple yet powerful: to streamline the document preparation process for loan companies. They’re not just ticking boxes; they’re solving real problems that plague the lending industry. According to their website, their goal is to “empower loan companies with efficient and compliant document solutions.”

This fresh perspective is one of the reasons they’re catching attention. They’ve built their company around customer-centric values and a passion for operational efficiency. Simply put, they care about doing the heavy lifting so you can focus on growing your business.

How USABrightline Stands Out

USABrightline might be the new kid on the block, but they’re already giving competitors a run for their money. Here’s how:

Exclusive Focus: They don’t try to do everything. By specializing in document preparation, they deliver top-notch results in this niche. Fresh Perspective: As a newcomer, USABrightline leverages the latest tools and methods to address pain points other companies have yet to pay attention to. Customization: They don’t believe in cookie-cutter solutions. Every document is tailored to the client’s needs, helping them gain greater financial stability and success through personalized support.It’s this combination of focus, innovation, and flexibility that’s helping USABrightline make waves.

Customer Experiences and FeedbackSo, what are people saying? Early feedback paints a positive picture:

Clients appreciate their fast turnaround times, often completing projects ahead of schedule. Their accuracy is another highlight. Mistakes in loan documentation can be costly, and USABrightline’s attention to detail helps avoid unnecessary headaches. A few customers even commented on their customer service, describing it as “proactive and responsive.”For a young company, these glowing reviews are a good sign of things to come. View accompanying photos that illustrate the advanced features and design of USABrightline’s services.

USABrightline: Loan Services and OptionsWhen it comes to managing unexpected costs or planning for a big purchase, USABrightline offers a range of flexible loan solutions tailored to meet your unique financial journey. Whether you’re looking to consolidate debt, finance a home improvement project, or cover an emergency expense, USABrightline has you covered.

Their personalized loan options are designed to provide better control over your finances, ensuring you can access the funds you need quickly and efficiently. With competitive rates and a streamlined application process, USABrightline makes it easy to secure the financial support you need to achieve your goals. Focusing on your specific needs helps you take control of your financial future, making those dreams a reality without stress.

![]() Best Overall Service

Best Overall Service

4.5

4.5

![]()

![]()

![]()

![]()

![]() 800Financial

Direct Lending Excellence: Matches you with the best loans with optimal loan terms.

Comprehensive Loan Network: Loans ranging from $2,500 to $50,000

Flexibility & Speed: Flexible terms from 3 to 120 months, 24 hours post-approval.

Learn More

800Financial

Direct Lending Excellence: Matches you with the best loans with optimal loan terms.

Comprehensive Loan Network: Loans ranging from $2,500 to $50,000

Flexibility & Speed: Flexible terms from 3 to 120 months, 24 hours post-approval.

Learn More

In today’s digital age, security, and data protection are paramount, and USABrightline takes this responsibility seriously. The company employs advanced encryption methods to safeguard your sensitive information, ensuring that all data transmitted between your browser and their website remains confidential and secure.

USABrightline’s website is registered with Google Trust Services and boasts a valid SSL certificate, providing an additional layer of security and trust. Their robust data protection policies are designed to comply with industry standards, giving you peace of mind when sharing your financial information. With USABrightline, you can rest assured that your data is in safe hands.

USABrightline: Pros and ConsLike any company, USABrightline has its strengths and areas for improvement. Let’s break it down.

Pros Tailored Solutions: They understand that one size doesn’t fit all. Efficiency: Their processes save clients time and money. Customer Focus: Early feedback suggests they prioritize client satisfaction. Specialization: Their narrow focus leads to expertise in document preparation. Siemens Mobility: Siemens Mobility plays a key role in the development of high-speed rail systems and in designing and manufacturing modern trainsets for operators like Brightline. They are committed to innovation, sustainability, and creating a seamless passenger experience in the rail industry. Cons Newness: Being new means fewer long-term case studies or reviews to reference. Scaling: As they grow, maintaining this level of personalization might be challenging.Overall, the pros outweigh the cons, especially if you value a fresh, dedicated approach to document prep.

Read More: Secured vs. Unsecured Loan: Which Is The Best Option?

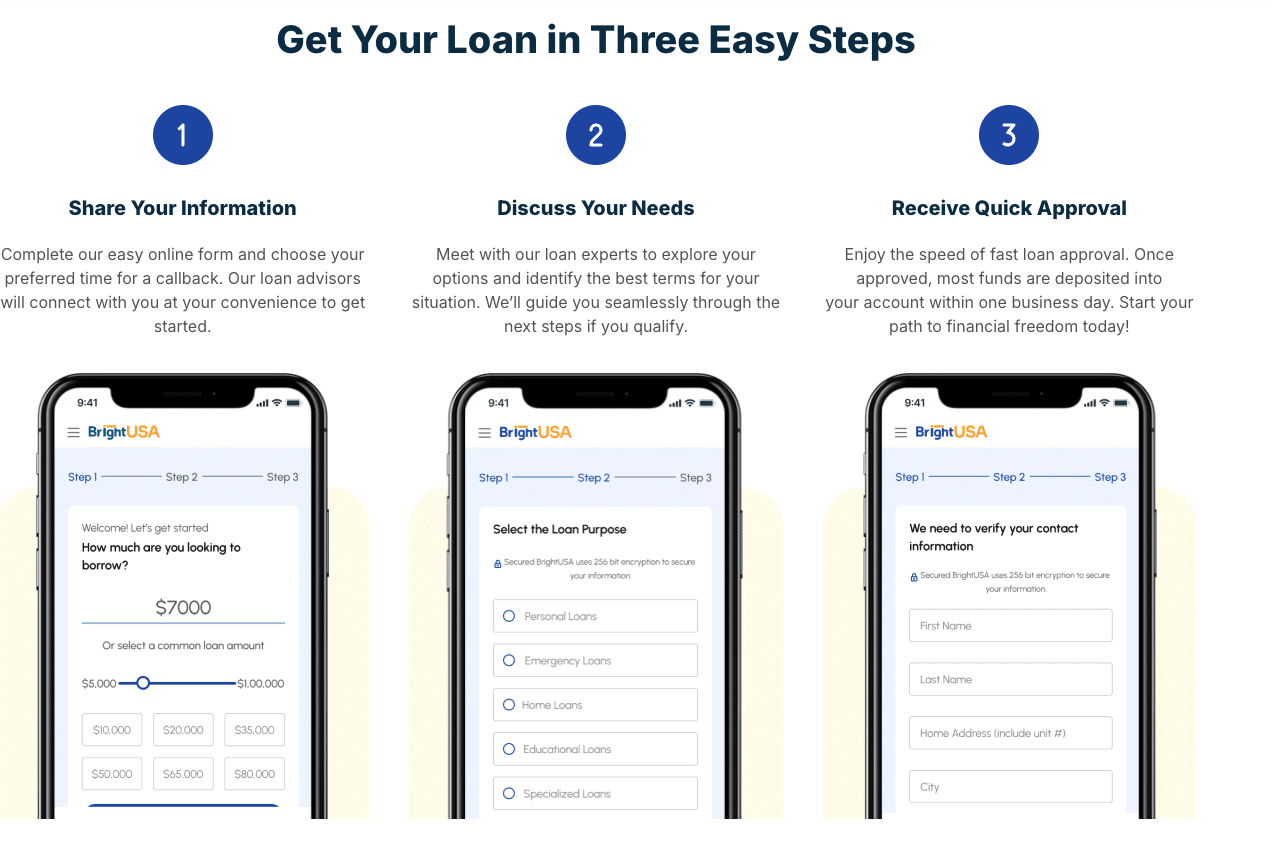

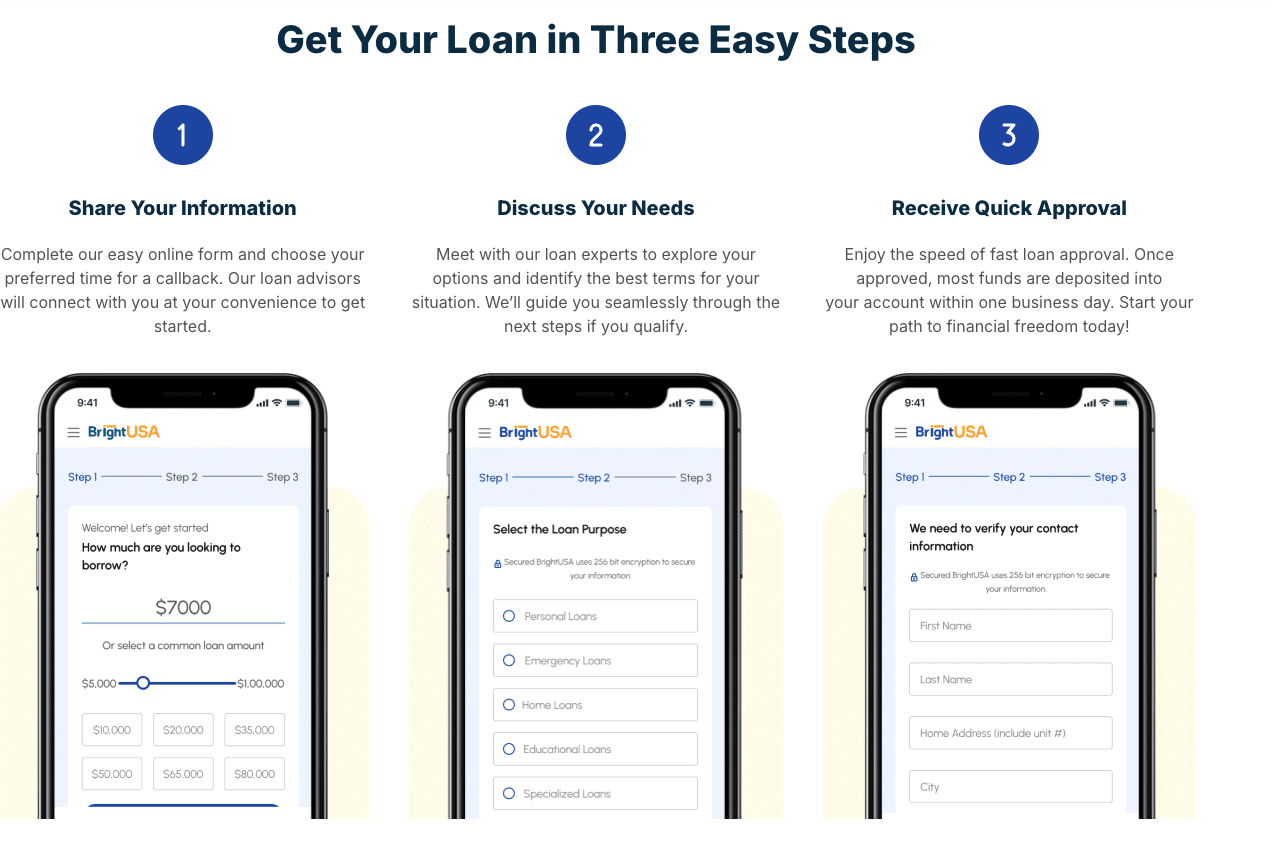

How to Get Started With USABrightline

Picture this: You’re sitting in your pajamas, coffee in hand, evaluating the trustworthiness and safety of the USABrightline site while filling out a simple online form. That’s literally how easy it is to start. No fancy dress code is required! The form asks for basic information about your loan needs and preferred contact time.

Step 2: The Consultation DanceThis is where USABrightline really shows its colors. Their loan consultants don’t just throw numbers at you – they take the time to understand your financial story. It’s like having a financial therapist, minus the couch and the “how does that make you feel?” questions.

Step 3: The Quick DecisionRemember waiting weeks for loan approval? Neither does USABrightline. Most applications receive a decision faster than you can say “debt consolidation” three times fast.

Conclusion

Their strength lies in combining modern technology with human expertise, making the loan process less intimidating and more accessible.

While they may not be the perfect fit for everyone (particularly those seeking smaller loans or those with lower credit scores), their commitment to customer service and transparent lending practices makes them a solid choice for many borrowers.

If you’re ready to ditch the paperwork and partner with a company that gets it, check out USABrightline. They might be the solution you didn’t know you needed.

So, what are you waiting for? Make your life easier—one document at a time!

FAQs About USABrightline What does USABrightline specialize in?USABrightline focuses on document preparation services for loan companies, ensuring compliance and efficiency. Also, USABrightline specializes in personal loans, home improvement financing, and debt consolidation loans, offering amounts between $5,000 and $100,000. Additionally, USABrightline is involved in the Brightline West project, which is developing a high-speed rail line connecting Las Vegas to Los Angeles.

Is USABrightline a reliable company?Yes, USABrightline has established itself as a reliable lender with transparent practices, competitive rates, and strong customer service support.

How does USABrightline support loan companies?They provide personalized consultation, quick approval processes, next-day funding for approved loans, and ongoing support throughout the loan term.

Are USABrightline’s services customizable?Yes, they offer flexible loan terms and amounts, working with borrowers to create loan solutions that fit their specific financial situations.

How can I contact USABrightline?You can reach USABrightline through its website (usabrightline.com) or by calling its dedicated support line at +1 (888) 599-8343. For direct contact options, visit its website.

Want stories like this delivered straight to your inbox? Stay informed. Stay ahead. Subscribe to InqMORNING legendplay

MORE STORIES Accredited Debt Relief: Reviews and Ratings LendcoFunding: Reviews and Ratings Better Tax Relief: Tax Resolution Services Explained Follow @FMangosingINQ on Twitter --> Don't miss out on the latest news and information.